gambling income tax calculator

Its calculations provide accurate and. If there was Yonkers tax withheld add it to your total for that withholding for the year and put the sum on Line 74 of your IT-201.

Paying Taxes On Gambling Winnings Do I Need To Pay Taxes On My Wins

Sports betting platform providers will also have to pay a.

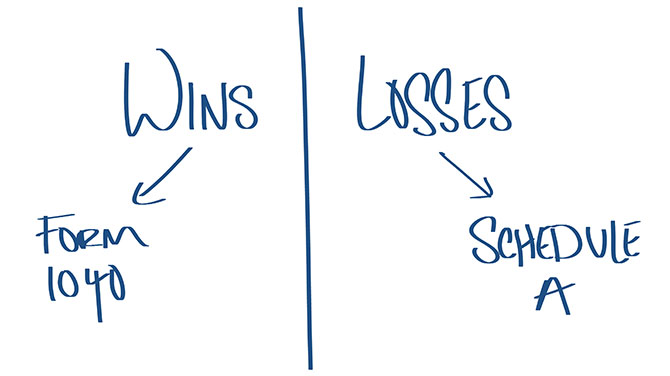

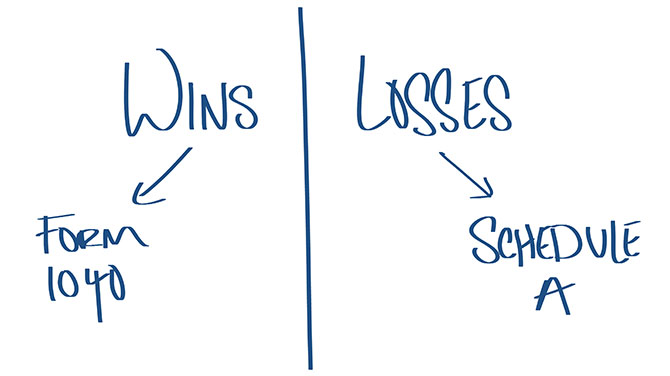

. Discover the best slot machine games types jackpots FREE games. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Once completed youre done with your.

This page contains a calculator for computing the income tax liability on gambling winnings. Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Discover the best slot machine games types jackpots FREE games.

Players should report winnings that are. It takes into account gambling losses non-gambling income the amount of itemizable. You total all your loosing sessions.

Tax rates depend on your annual income and tax bracket. Now for tax purposes you cannot just subtract losses from winnings and report your net as additional income. Here is a complete overview of all state related income tax return links.

Taxable Gambling Income. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. Maryland Gambling Tax Calculator.

Gambling income includes but isnt limited to winnings from lotteries raffles horse races and casinos. The effective tax rate is the actual percentage you pay after taking the standard deduction and other possible deductions. Gambling income is subject to state and federal taxes but not FICA taxes and the rate will.

Ohio Lottery taxes are virtually identical to gambling taxes. World poker tour shop borgata poker. This is your gambling losses.

If you win more than 600 Ohio will withhold taxes of 4 while federal regulations will withhold taxes somewhere. Marginal tax rate is the bracket your income falls into. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate.

Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. Gambling Income Tax Calculator - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. The state will claim 51 of the operators gross gambling revenue compared to a median tax rate of 11 nationwide.

Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Gambling winnings are fully taxable and you must report the income on your tax return. Marginal tax rate is your income tax bracket.

Individual Income Tax Colorado General Assembly

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Income Taxes And Sports Betting In 2018 Taxact Blog

New York Gambling Winnings Tax Calculator For October 2022

Gambling Winnings Tax H R Block

1040 Income Tax Calculator Free Tax Return Estimator Jackson Hewitt

Reporting Gambling Winnings And Losses On Your Tax Return 1040 Com Blog

Gambling Winnings Tax What You Need To Pay Playtoday

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

Complete Guide To Taxes On Gambling

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Reporting Gambling Winnings And Losses On Your Tax Return 1040 Com Blog

Free Gambling Winnings Tax Calculator All 50 Us States

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Hawaii Income Tax Hi State Tax Calculator Community Tax

The Ultimate Guide To Gambling Tax Rates Around The World

Free Gambling Winnings Tax Calculator All 50 Us States