child tax credit 2021 dates irs

Discover Helpful Information And Resources On Taxes From AARP. 3 3advance child tax credit payments in 2021 irs.

What Families Need To Know About The Ctc In 2022 Clasp

We dont make judgments or prescribe specific policies.

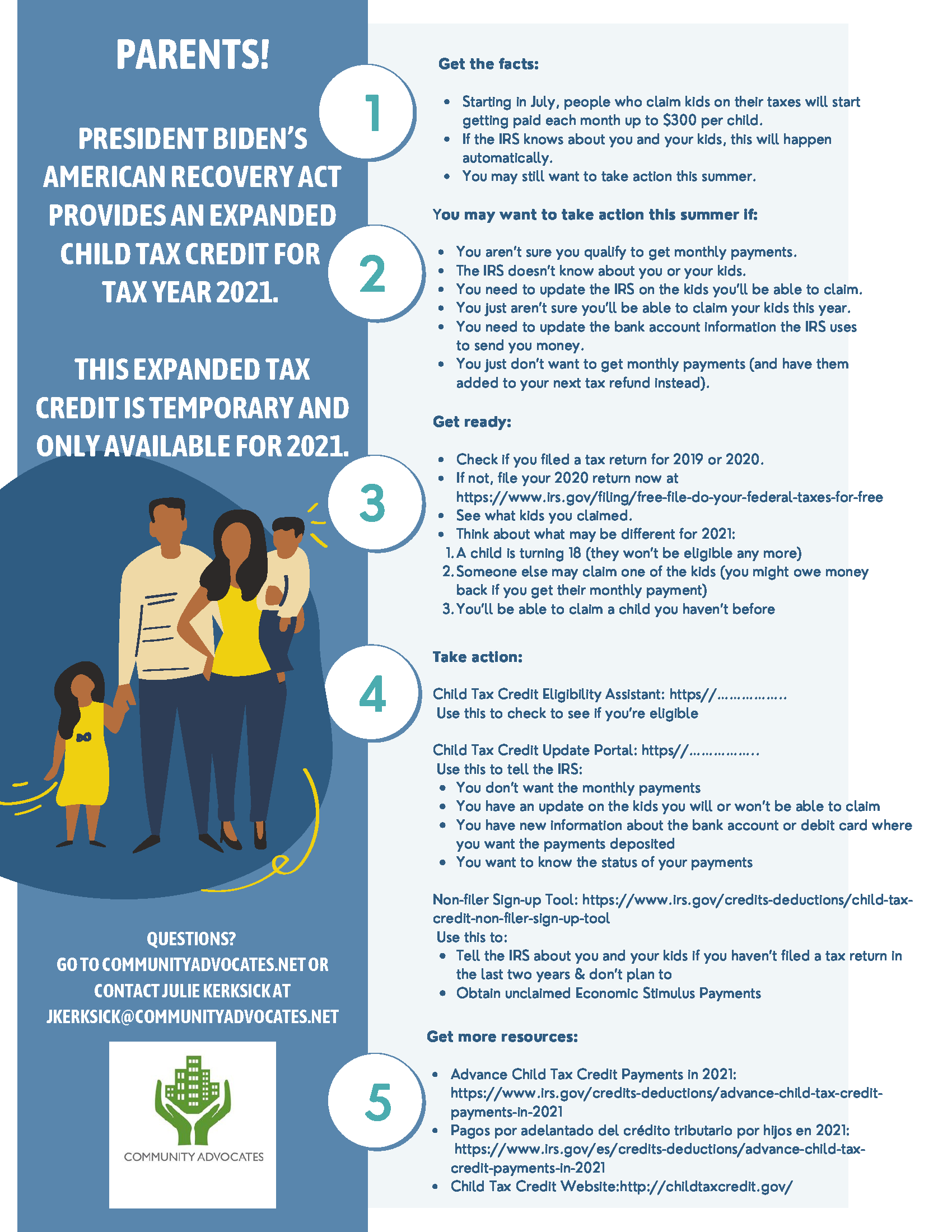

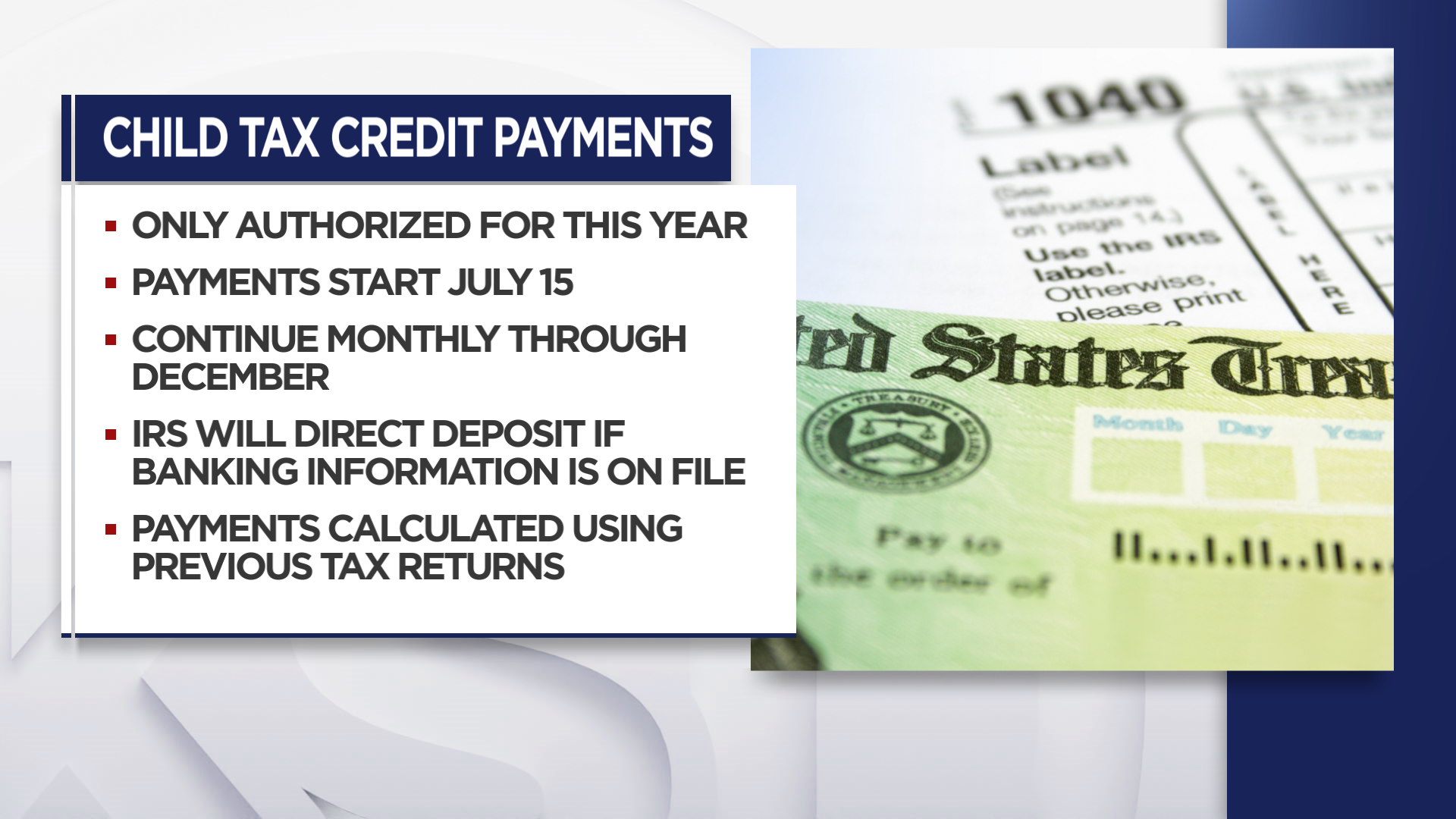

. New 2021 Child Tax Credit and advance payment details. The enhanced Child Tax Credit increased this benefit as high as 3600 a child. The IRS is distributing half of the credit as an advance on 2021 taxes in six.

For 2021 only the child tax credit amount was increased from 2000 for each. In some cases these monthly payments will be made beginning July 15 2021 and through. Thank you for visiting our web page about economic impact payments EIP the Child Tax.

Ad Browse discover thousands of unique brands. The only way to receive the credit is to file a 2021 federal tax return. See what makes us different.

What is the child tax credit. 1 1Eligibility Rules for Claiming the 2021 Child Tax Credit on a. After that taxpayers can expect the payments in their bank accounts roughly.

Read customer reviews best sellers. To get the full enhanced CTC which amounts to 3600 for children under 6. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying.

The reasons for the people being left out are several but the Internal Revenue. The CTC begins to be reduced to 2000 per child if your modified AGI in 2021. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child.

The 2021 child tax credit payment dates along with the deadlines to opt out. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The 2021 child tax credit payment dates along with the deadlines to opt out are.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax. Because of the COVID-19 pandemic the CTC was expanded under the American. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

When universal credit child.

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

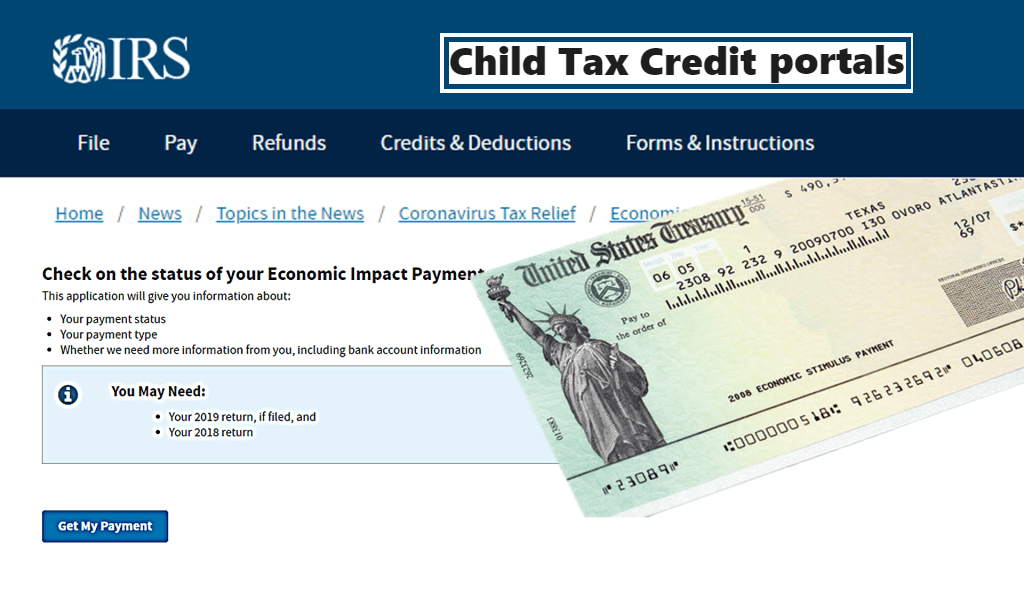

1040 2021 Internal Revenue Service

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Child Tax Credit What We Do Community Advocates

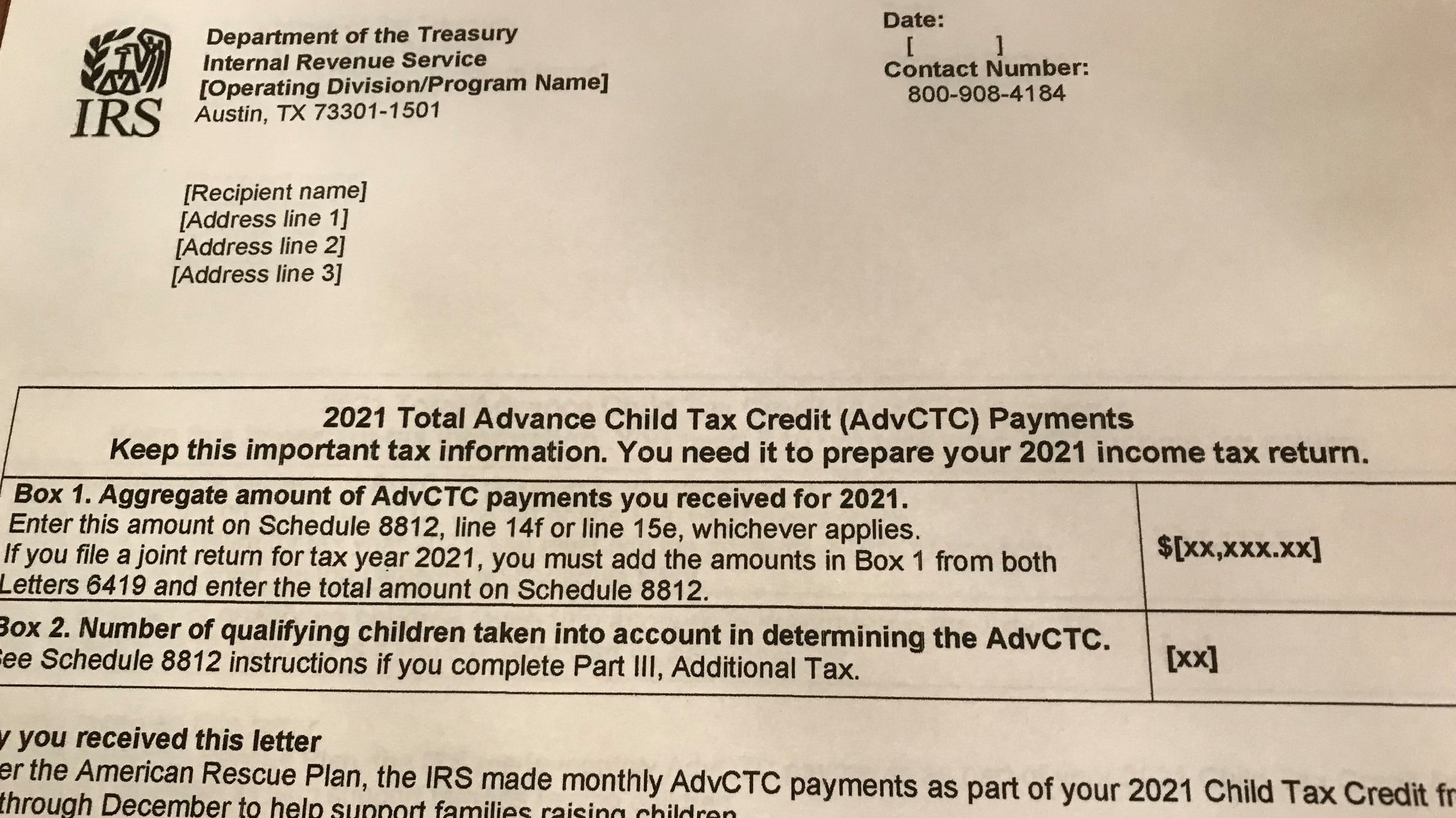

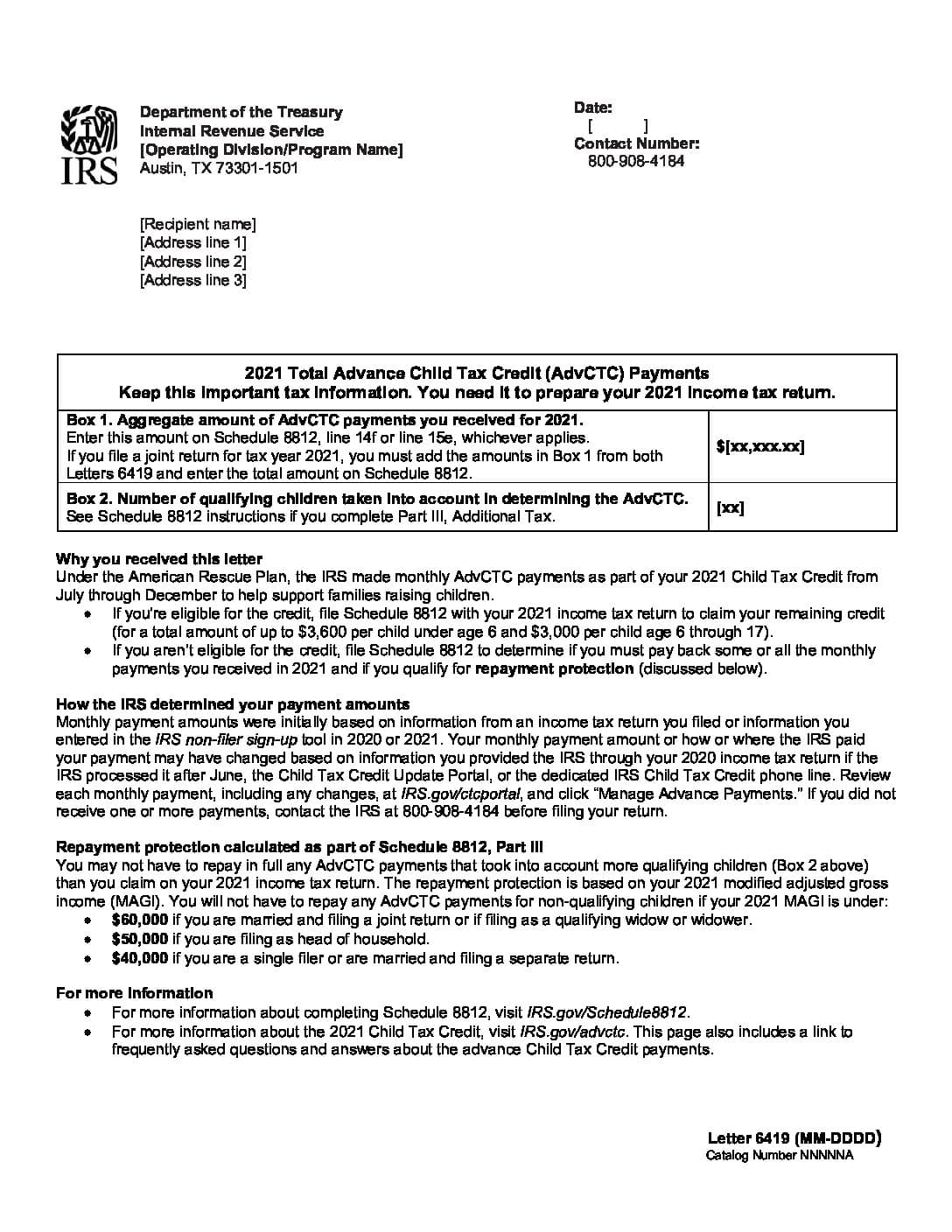

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Sending Letters About Child Tax Credit

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Taxpayers Now Can Go Online To Opt Out Of Advance Child Tax Credit Payments Verify Eligibility Don T Mess With Taxes

Advance Child Tax Credit Short Or Missing Navigate Housing

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

August Child Tax Credit Payments Issued By Irs Why Yours Might Be Delayed

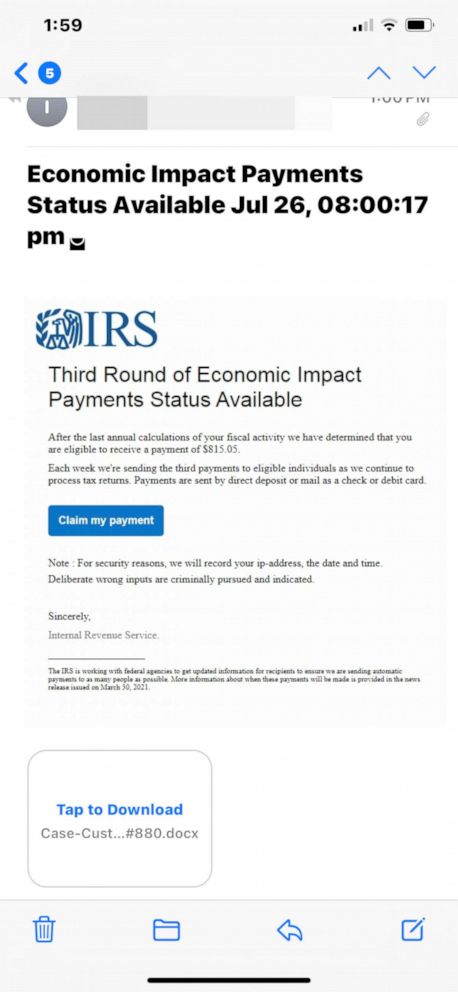

Irs Warns Of Child Tax Credit Scams Abc News

Irs To Send Letter 6419 Regarding Advance Ctc Payments Lanigan Ryan

Advance Child Tax Credit Filing Confusion Cleared Up

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook